To achieve global goals, the mobilisation of public and private resources is key. The participation of financial institutions, banks, institutional investors, corporations and capital markets play a crucial role in aligning financial flows with sustainable and green finance.

For this reason, it is essential to provide investors with information on activities that contribute to meeting climate change and natural resource conservation objectives. Green or sustainable taxonomies are designed as classification systems with criteria and indicators to classify different economic activities according to their contribution to climate change mitigation and adaptation, or to the sustainability of the country. In other words, it classifies funds according to their objectives, thus giving certainty to the market, avoiding green and social washing. Thus, the creation of green, sustainable or climate finance taxonomies helps in this process and becomes the foundation of a green financial system. The financial sector must consider environmental issues – in particular climate change – as inherent to its business and continuously conduct risk and opportunity analyses related to the environment and climate.

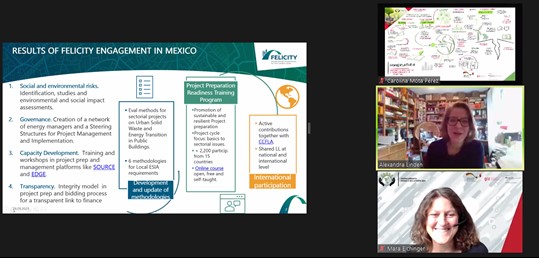

This guide seeks to draw on the experiences of the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH, through the Mexican-German Climate Change Alliance, in developing two processes for the creation of taxonomic classification systems for finance; one with the banking sector through the Association of Banks of Mexico (ABM), focused on green assets; and the other with the Government of Mexico, in the identification of economic activities and a methodology for defining metrics and thresholds for the country’s sustainable financing taxonomy. The objective is to share with other countries the lessons learned and best practices for implementing and operating a classification system for economic activities that contribute to sustainability and/or climate change within their country.

Consult the Guide for Creating a Green and Sustainable Finance Taxonomy: Lessons Learned from Mexico’s Government and Banking Sector, click on the following image: